wise counsel

Overview

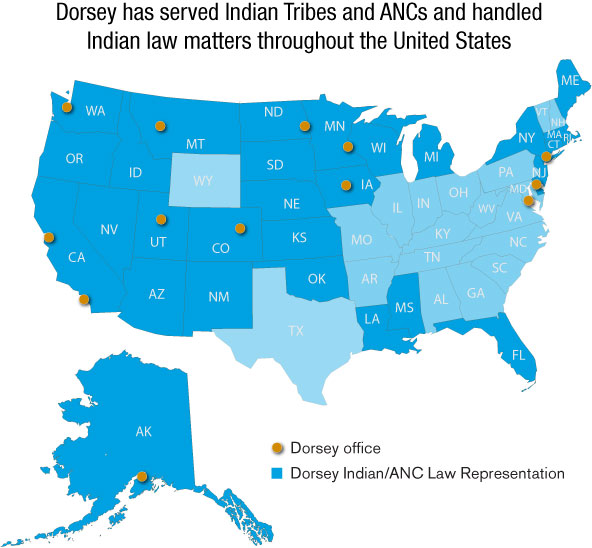

Dorsey was a leader in developing a full-service Indian and Alaska Native practice, and our longstanding, nationwide commitment is recognized consistently. We have one of the best Native American law practices in the United States, according to Best Law Fims and Chambers USA, and we offer the unique features of a full-service law firm with deep experience representing Indian tribes and Alaska Native corporations.

Attorneys in this practice include tribal members and other lawyers who regularly represent clients in all aspects of service, including:

-

Tax planning, tax controversy and tax litigation

-

Litigation, arbitration and appellate law

-

Banking, finance and financial restructuring

-

Benefits and compensation

-

Labor and employment

-

Government contracts

-

Gaming

-

Corporate representation

-

Economic development

-

Cultural resources

-

Energy and environment

-

Federal representation

Experience

Nationwide Reach

Alaska Native Matters

Dorsey & Whitney LLP provides transaction and litigation services to Alaska Native regional and village corporations, their subsidiaries, joint ventures and individual shareholders, as well as clients doing business with Alaska Native corporations. Dorsey has extensive experience counseling Alaska Native corporations, their subsidiaries and joint ventures, lenders and other clients doing business with Alaska Native corporations in merger and acquisition transactions, financing, real estate sales and leasing, land and natural resource management, oil drilling contracts, business contracts, general corporate matters, shareholder relations and proxy and shareholder meeting issues. Dorsey's attorneys represent these clients in state and federal trial and appellate courts in cases involving a broad array of issues, including election matters, proxy solicitations, land conveyances under the Alaska Native Claims Settlement Act and complex commercial disputes.

Benefits, Compensation & Retirement Plans

Dorsey assists a number of Tribes and tribal entities on employee benefits ranging from health insurance and fringe benefits to retirement plans. The Pension Protection Act of 2006 amended the Internal Revenue Code and ERISA to make it more difficult for Tribes to assert that tribal plans are governmental plans that are exempt from nondiscrimination, reporting and disclosure, fiduciary requirements, and enforcement and penalties by the DOL and IRS.

Representative Matters

Dorsey has worked on the following:

- Dorsey is working with the IRS to clarify the ability to include compensation excluded from income under section 7873 when determining compensation for purposes of contributions to and accrual of benefits under tribal retirement plans.

- Dorsey has assisted employers in reviewing retirement plan amendments and compliance with changes in the law.

- Dorsey has assisted employers with questions on the Pension protection Act and the transition relief provided under Notice 2006-89 and Notice 2007-67.

- Dorsey has assisted with the tribal entities with questions regarding health care reform (the Patient Protection and Affordable Care Act and the Health Care and Education Reform Act).

- Dorsey has assisted with the development of child care programs and a child care center.

Compliance and Penalties

The IRS and DOL are increasing their enforcement of the Code and ERISA. penalties under these statutes can be severe, including penalties of up to $1,100 per day for late filing of Form 500 and substantial penalties for HIPAA violations. Our attorneys work with tribal entities to review their plans and assist them in complying with the lengthy and complex rules that govern employee benefits, compensation, and retirement plans.

Litigation and Appellate Practice

Dorsey’s Indian law litigation experience includes representation of tribes, tribal entities and tribal officials in a broad variety of litigated matters. Dorsey has appeared on behalf of tribal clients in tribal, federal and state courts across the country, and also in arbitrations and before federal agencies. Dorsey has handled significant cases in Indian country involving treaty rights, state taxation, employment, election and membership disputes, breach of contract, breach of trust duty, federal recognition, and gaming, among other areas.

Representative Litigation Matters

Dorsey has achieved litigation success in all stages of litigation in a wide range of Indian law cases. Here are a few recent examples.

- Dorsey represented an Indian Tribe in litigation against the Indian Health Service and Bureau of Indian Affairs for underpayment of contract support costs under Indian Self-Determination and Assistance Act (ISDA) contracts.

- Dorsey represented an Indian Tribe in federal court litigation against the state of Michigan Revenue Officials challenging the state’s attempt to impose ad valorem property taxes against the Tribe and its members on fee land within the Tribe's Reservation. Dorsey obtained summary judgment on behalf of the Tribe and that decision was affirmed by the Sixth Circuit Court of Appeals.

- Dorsey represented an Indian Tribe, one of its tribal corporations and various tribal officials in federal court litigation against Kansas Revenue Officials regarding the state’s seizure of the tribal corporation's gas tanker truck and the state’s attempt to impose a state fuel tax on sales of fuel by the tribal corporation to Indian tribes in Kansas. Dorsey obtained a temporary restraining order and preliminary injunction from the Federal District Court in Kansas, and this injunctive relief was affirmed by the 10th Circuit Court of Appeals. Dorsey later obtained summary judgment on behalf of the Tribe, the tribal corporation and tribal officials.

- Dorsey currently represents an Indian Tribe in federal court challenging an attempt by a city and state government to impose personal property taxes on gaming devices leased by the Tribe for use in the Tribe’s gaming facility. While the federal case is ongoing, we have obtained a stay of a state court tax case brought by the township, and have also obtained several key discovery rulings in favor of the Tribe.

- Dorsey recently represented a Tribe in its Tribal Court against a challenge to the Tribe’s implementation of a random drug testing policy among its government and tribal employees. The Tribal Court recently ruled in favor of the Tribe, upholding its random drug testing policy. The matter is on appeal to the Tribe’s Appellate Court.

- Dorsey represented an Indian Tribe in federal and tribal court litigation arising out of a golf course development and management contract. Dorsey obtained dismissal of the federal court action on behalf of the Tribe, and eventually assisted the Tribe in obtaining a very favorable settlement after several key rulings in favor of the Tribe in Tribal Court.

Appellate Practice

Dorsey has handled federal appellate Indian law cases in the 2nd, 6th, 8th, 9th and 10th Courts of Appeals, the appellate courts in the states of California, Minnesota, Wisconsin, Kansas and Iowa, and the appellate tribal courts for the Keweenaw Bay Indian Community, the Winnebago Tribe of Nebraska, the Las Vegas Paiute Tribe and the Intertribal Court of Southern California. Dorsey has also filed amicus briefs for various tribal clients, including the National Congress of American Indians, with the United States Supreme Court.

Tax Planning, Controversy and Litigation

Dorsey has an extensive and comprehensive Indian tax practice representing clients throughout the United States. We have extensive experience representing tribes, tribal entities, and tribal members in all types of federal, state, and tribal tax matters. Here are some examples of our specific experience in these areas:

Representative Federal Administrative Tax Controversies, Tax Litigation, and Tax Rulings

- We have represented tribes, tribal entities, and tribal members in numerous IRS compliance checks, audits, and administrative appeals, involving tribal benefit programs, employment taxes, information reporting, income tax withholding, worker classification, penalties, tax-exempt financing, excise taxes, and cash transaction reporting issues. Currently, we are representing one tribe and three tribal entities in a large-scale, complex audit, and two tribes in administrative appeals involving a six-figure civil penalty issue and a six-figure worker reclassification issue, respectively. Recently, we represented another tribe in successful negotiations with the U.S. Department of Justice – Tax Division to resolve a seven-figure dispute over back payroll taxes.

- We have successfully represented tribes in the course of IRS examinations and in an administrative appeal in which the IRS has challenged the tribe’s classification of its board, committee, and commission members as independent contractors rather than as employees.

- Little Six, Inc. v. United States, 210 F.3d 1361 (Fed. Cir. 2000), holding that federal wagering excise and occupational taxes do not apply to Indian tribal governments. (This result was subsequently overturned by the U.S. Supreme Court in a case in which we did not represent the tribes involved.)

- PLR 200511006 (Nov. 23, 2004), ruling that funds distributed to tribal members constitute income from a fishing rights-related activity and therefore are exempt from federal income, FICA, and FUTA taxes.

- TAM 200106007 (Feb. 12, 2001), holding that a trust program for minor tribal members gives rise to income tax when amounts are distributed from the trusts to the tribal members and not before.

IRS unpublished general information letter (Oct. 25, 2000), discussing the income tax consequences of a tribal housing loan program with a loan forgiveness feature, involving a significant issue of first impression in the IRS National Office. - PLR 200022048 (June 5, 2000), similar to TAM 200106007, also involving a significant issue of first impression.

- PLR 199908006 (Nov. 17, 1998), ruling that a deferred per capita benefit program for electing adult tribal members using “Rabbi trust” funding vehicle achieves income tax deferral, also involving a significant issue of first impression.

- PLR 9847018 (Nov. 20, 1998), ruling that a Section 17 corporation will be treated as a state for purposes of issuance of tax-exempt obligations, also involving a significant issue of first impression.

Representative State Tax Litigation, Administrative Tax Controversies, and Tax Rulings

- Mashantucket Pequot Tribe v. Town of Ledyard et al., 2012 WL 1069342 (D. Conn. Mar. 27, 2012) (slip copy), holding that federal law precluded the Town of Ledyard from imposing its personal property tax on the Tribe’s leased gaming machines and, as a result, awarding summary judgment to the Tribe. The Town and the State of Connecticut are appealing the judgment in this case to the U.S. Court of Appeals for the Second Circuit.

- Mashantucket Pequot Tribe v. Town of Ledyard, et al., 2008 WL 4298377 (D. Conn. Sept. 18, 2008), holding that broad financial information regarding the Tribe is not discoverable by the Town and the State of Connecticut in a case concerning the applicability of the Town’s personal property tax to gaming equipment leased by the Tribe and used in the Tribe’s gaming enterprise, because the parties’ relative financial circumstances are not relevant to federal preemption analysis.

- Winnebago Tribe of Nebraska, et al. v. Morrison, et al., Case No. 02-4070-JTM (D. Kan. Sept. 6, 2007), awarding summary judgment to tribes engaged in Indian nation-to-Indian nation trading against Kansas officials who sought to enforce the Kansas motor fuel tax laws against the tribes and tribal officials (four earlier favorable decisions in this case are reported at 150 P.3d 892 (Kan. 2007), 341 F.3d 1202 (10th Cir. 2003), 216 F. Supp. 2d 1226 (D. Kan. 2002), and 205 F. Supp. 2d 1217 (D. Kan. 2002)).

- Keweenaw Bay Indian Community v. Naftaly, 452 F.3d 514 (6th Cir.), cert. denied, 127 S. Ct. 680 (2006), affirming grant of summary judgment enjoining Michigan officials from enforcing the Michigan General Property Tax Act against lands owned in fee simple by the tribe and tribal members within their Indian reservation (an earlier favorable decision in this case is reported at 370 F. Supp. 2d 620 (W.D. Mich. 2005)).

- We have represented a tribe and numerous of its members before a state taxing agency in cases in which the agency has challenged tribal members’ residency on the reservation and asserted the right to tax income from tribal members’ passive investments in intangible property and income earned outside the state.

- We have obtained rulings and exemption certificates from various states recognizing the inapplicability of state sales and use taxes to reservation construction projects.

Tax-Related Services Experience (Not Involving Litigation or Administrative Agency Practice)

- We have advised numerous tribes and tribal entities regarding available federal and state tax exemptions, the legal incidence of potentially applicable state taxes, application of the balancing test used in federal preemption analysis, and related tax planning.

- We have advised numerous tribes and tribal entities regarding enterprise and investment structuring and other economic development and investment tax planning.

- We drafted a comprehensive revision to the tribal tax code for a large tribe with a large reservation and provided related advice to the tribe regarding the scope of its taxing power permitted under federal law.

- We have advised numerous tribes and tribal entities regarding compliance with applicable federal and state tax laws involving employment taxes, income taxes, property taxes, sales and use taxes, and other excise and transaction taxes.

- We submitted comments to the IRS for several tribal clients regarding proposed entity classification regulations and pending IRS guidance projects on tribal law corporations and tribal minors’ trust programs.

- We have developed and drafted numerous revenue allocation plans, minors’ trust programs, and adult deferred per capita benefit programs.

- We have reviewed existing revenue allocation plans and tribal benefit programs for several tribal clients and developed and drafted amendments to such plans and programs to minimize tax risks.

- We have developed and drafted numerous tribal housing, education, health, elder, utilities assistance, and emergency and other assistance programs intended to qualify as general welfare programs providing nontaxable benefits to tribal members.

- We have served as bond counsel in dozens of tax-exempt financings and refinancings for tribal clients.

- We have advised and assisted tribal clients in all types of employee benefit matters.

We served as the principal presenters at the two-day Tribal-State Tax Summit convened by the Coushatta Tribe of Louisiana and attended by tribal and state officials in November 2002. - We provided technical analysis and assisted tribal clients in lobbying against proposals to tax tribal gaming income in the mid-1990s and against the more recent Prevent All Cigarette Trafficking Act legislation.

- We provided technical analysis and assisted tribal clients in lobbying in favor of various proposals to liberalize rules governing tribal tax-exempt financings.

Tribal Finance

Dorsey has represented tribes and financing sources to tribes in connection with the financing of tribal governmental projects, land acquisition, health care facilities, schools, community centers, water and sewage facilities, recreational projects, golf courses, convention centers, law enforcement and public safety facilities, class II and class III gaming projects, resorts, hotels and other reservation economic development facilities.

Representative Work

Tribal Taxable Bond Financings

Dorsey has served as counsel either to the Tribal issuer or the underwriter in connection with bond and note financings, including the following structures:

- Bonds payable from gaming or other enterprise revenues

- Bonds insured by bond insurance

- Bonds secured by bank letters of credit

- We conceived and developed the “depository” structure now widely used in Indian country financings. This structure enables a tribe to undertake future borrowings on a parity with earlier borrowings as tribal revenues, and resulting borrowing capacity, grow

Tribal Commercial and Syndicated Bank Financings

Dorsey has represented either the Tribal borrower or one or more lending financial institutions in numerous financings of gaming, hotel and related facilities, and other reservation-based economic development projects, including:

- Single bank loans and loans from institutional investors

- “Club” bank financings

- Syndicated bank loans

- Transactions that involve combinations of one or more of the foregoing elements and bonds or notes

Tribal Tax-Exempt Financings

Dorsey was the bond counsel on the first tribal tax-exempt financing undertaken by a tribe in the United States under the Tribal Government Tax Status Act, a financing by the Fond du Lac Band of Lake Superior Chippewa for a reservation clinic in 1985. Dorsey has served as bond counsel to the tribal issuer, or as counsel to the underwriter or lender, on tax-exempt financings for over 25 tribes listed here. Dorsey’s experience in tax-exempt tribal financings includes virtually all types of tax-exempt transactions, including bond issues, loans, revolving credit lines and lease financings. In addition, Dorsey has been actively involved in the tribal economic development bond program established as part of the American Recovery and Reinvestment Act of 2009, working closely with tribes, industry groups and the IRS on program implementation and efforts to enhance the effectiveness and utilization by tribes of the program.

Tribal Financial Restructuring & Bankruptcy

Dorsey has experienced bankruptcy lawyers, but also lawyers specifically experienced in Indian law and the insolvency of Indian owned entities and gaming facilities. Dorsey’s group of insolvency lawyers work closely in conjunction with Dorsey’s experienced lawyers in Indian and gaming law. Dorsey’s lawyers doing insolvency and restructuring work represent secured creditors, creditors’ committees, distressed companies, debtors in possession, acquirors of distressed companies or their assets, investors, indenture trustees, debtor in possession lenders, specialty lenders, financial services companies, and other participants in reorganization, liquidation, insolvency, and workout proceedings. The group’s restructuring advisory services for distressed companies focus on out-of-court restructurings, foreclosures and chapter 11, including “prepackaged” and “prearranged reorganizations.”

Industries & Practices

Government Contracts Counseling & Litigation

Explore This Practice View resources related to this practice- Bankruptcy & Financial Restructuring

- Benefits & Compensation

- Commercial Litigation

- Environmental

- Government Contracts Counseling & Litigation

- Labor & Employment

- Lending Transactions

- Public Finance

- Public-Private Partnerships

- Real Estate & Land Use

- Trusts & Estates

featured resources