On 6 April 2016, amendments to the Companies Act 2006 (the “Act”) came into effect that require companies incorporated under the Act (including companies limited by guarantee) and limited liability partnerships to produce and maintain a register of people with significant control (a “PSC Register”). Companies whose shares are admitted to trading on a regulated EEA market or which have disclosure obligations under DTR 5 (such as AIM-listed companies and main market (premium and standard listed) companies) are exempt from the requirement to maintain a PSC Register (although any UK subsidiaries of such companies will not be exempt). Companies will be required to include details of PSCs on their confirmation statement, which will replace the annual return from 30 June 2016.

What is a person with significant control?

A PSC is an individual who meets any of the following conditions in relation to a company:

- directly or indirectly holds more than 25% of the shares in the company (by nominal value);

- directly or indirectly holds more than 25% of the voting rights in the company;

- directly or indirectly holds the right to appoint or remove a majority of the directors of the company;

- has the right to exercise, or actually exercises, significant influence or control over the company; or

- has the right to exercise, or actually exercises, significant influence or control over a trust or firm that is not a legal entity, which in turn satisfies any of the first four conditions.

With regards to the fourth condition, “significant influence” and “control” are alternatives. "Control" indicates that a person has the right to direct the policies and activities of a company, whereas "significant influence" allows a person to ensure that the company adopts the policies and activities that the person desires. Further details of the fourth condition are set out in the Guidance for companies published by the Department for Business, Innovation and Skills (“BIS Guidance”).

The conditions in relation to an LLP are broadly equivalent. Companies must also record in their PSC Register any legal entities that are subject to their own disclosure requirements (whether keeping a PSC Register, being listed on a specified market or being subject to DTR 5) and who would be PSCs if they were individuals. Such entities are referred to as “relevant legal entities” (“RLEs”). If there is an RLE listed in a company’s PSC Register, the company does not need to “look above” that RLE (as the RLE will have its own PSC Register or other disclosure requirement). This allows significant control to be tracked through a corporate chain without the same information having to be recorded in multiple registers.

What should the PSC Register contain?

The new sections of the Act require companies to take reasonable steps to establish whether or not they have registrable PSCs or RLEs. As well as these investigations, companies are also required to send notices to anyone whom they believe, or have reasonable cause to believe, is a registrable PSC or RLE. The BIS Guidance contains pro-forma letters to be sent to persons who may be PSCs or RLEs. The notices require the person concerned to confirm whether they are a registrable PSC or RLE and, if so, to give the required particulars that must be included in the PSC Register. The required particulars are:

| PSC | RLE |

| Name |

Corporate or firm name |

| Service address |

Registered or principal office |

| Country or state of usual residence |

Legal form and governing law |

| Nationality |

Company registry and registration number |

| Date of birth |

Date of becoming a registrable RLE |

| Usual residential address |

Nature of the RLE’s control |

| Date of becoming a registrable PSC |

|

| Nature of the PSC’s control |

|

People who receive such a notice must respond within one month. In addition, people or entities that know or reasonably ought to know that they are a registrable PSC or RLE are under a corresponding obligation to inform the relevant company of such status and to provide their required particulars.

A company can only include a registrable PSC’s details in its PSC Register once such details have been confirmed by the PSC in question (although the same is not true of RLEs) and, when recording the nature of a PSC’s interest, must use prescribed wording set out in the BIS Guidance.

Failure to comply with the new laws regarding PSC registers is a criminal offence. Depending on the nature of the offence, penalties range from a fine to up to two years’ imprisonment.

The new rules regarding PSC Registers are complex and we would be happy to discuss them with you and to assist you in determining what actions you should take to comply. We have set out below some examples that illustrate the requirements for simple private and public corporate structures.

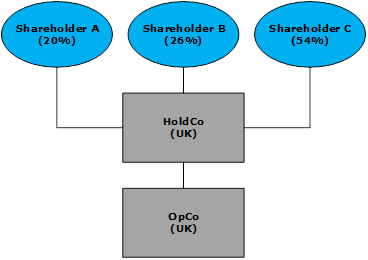

Example 1 – simple UK private company structure

In the example above:

- OpCo’s PSC Register will register HoldCo as an RLE; and

- HoldCo’s PSC Register will register Shareholder B and Shareholder C as PSCs.

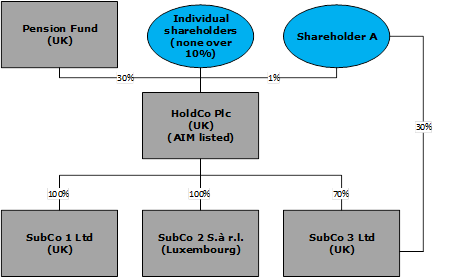

Example 2 – AIM-listed group

In the example above:

- SubCo 1’s PSC Register will register HoldCo Plc as an RLE;

- SubCo 2 is not required to keep a PSC Register;

- SubCo 3’s PSC Register will register HoldCo Plc as an RLE and Shareholder A as a PSC; and

- HoldCo Plc is not required to keep a PSC Register.

Please do not hesitate to contact Mark Taylor (taylor.mark dorsey.com) or David Elphinstone (elphinstone.david dorsey.com) if you would like further information about how the new requirements will affect you.